There’s a strange paradox in the benefits, TPA, and stop-loss world.

The more a broker tries to be chosen, the less likely serious companies are to choose them.

Not because buyers are cruel. Not because the broker lacks intelligence. Not because the market is unfair. Because desperation has a smell. And in professional advisory markets, smell travels faster than credentials.

You can hear it in a voicemail. You can see it on a website. You can feel it in the first five minutes of a meeting. It shows up in language, promises, posture, and pacing.

Call it the pick-me signal.

The pick-me broker is endlessly available, endlessly flexible, endlessly generous, endlessly promising – and somehow endlessly stuck with the wrong clients and the wrong deals. Everything looks polite. Everything sounds helpful. Everything feels “client-first.” And yet the outcomes keep disappointing.

Let’s walk through the five signals that give it away.

Sign #1: No Filters, No Boundaries, No “No”

Ask a pick-me broker who they serve best and you’ll get a beautiful, diplomatic answer that somehow includes the entire human population plus several industries not yet invented.

Everyone fits. Every case is welcome. Every structure is workable. Every opportunity is “interesting.”

It sounds open-minded. It reads generous. It operates like a vacuum cleaner.

Experienced brokers eventually discover a painful truth: the wrong client is not neutral. The wrong client is expensive. They drain time, delay progress, resist structure, and convert thoughtful strategy into background noise.

Top operators carry something most people avoid writing down — a clear anti-avatar. A profile of the client they will not serve. Not emotionally. Operationally.

Your criteria become real the day you decline a deal that was ready to sign. Until then, it’s philosophy. After that, it’s standards. Because strong positioning is not built by saying yes with better grammar. It’s built by saying no with a steady pulse.

Now Available on Amazon

Survivors inventors

A powerful playbook that shows you how to read every prospect’s mindset, smash through resistance to change, and unlock a clear vision of your brokerage’s future.

Sign #2: Free Work Flows Like Tap Water

The pick-me broker’s favorite pricing model is simple: free first, free deeper, free again, and maybe paid eventually if the stars align and Mercury is cooperative.

Free evaluations. Free deep dives. Free plan reviews. Free strategy modeling. Free redesign concepts. Delivered early, eagerly, and without friction.

Usually right after a confident promise made before any real data has been reviewed. Savings percentages appear in the air like fireworks: bright, impressive, and unsupported by gravity.

Meanwhile, the prospect is quietly thinking, “Excellent. I can use this.” And they do. Often with the incumbent.

In complex benefits strategy, premature free work is frequently just unpaid consulting that strengthens someone else’s renewal negotiation.

Serious experts protect depth work. Not because they’re stingy, because depth work is the product. When everything is free, nothing is valued. Including you.

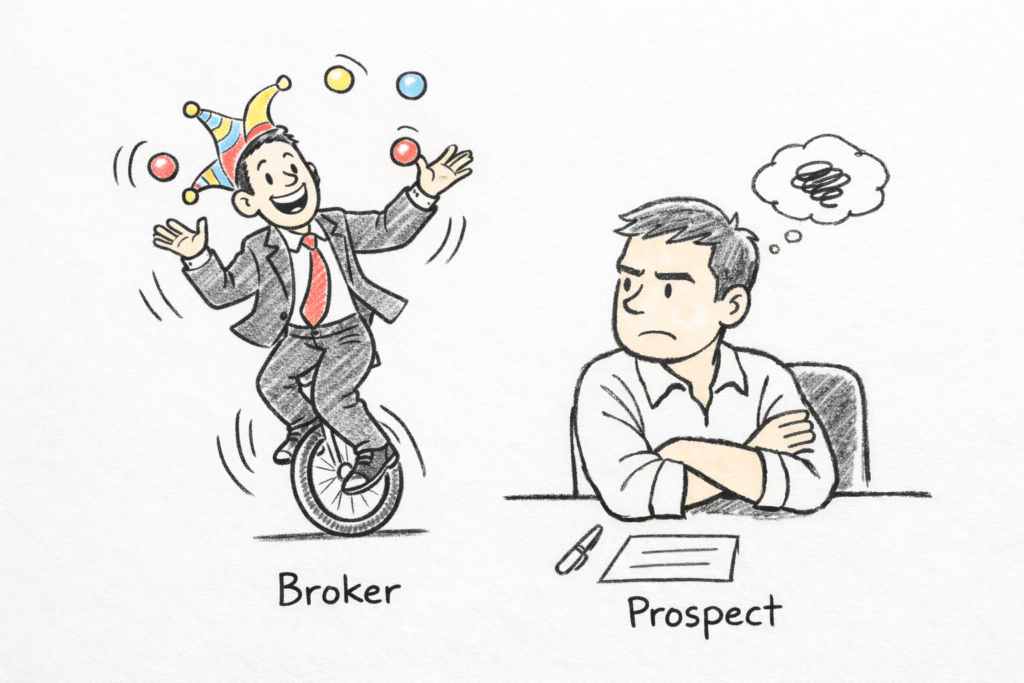

Sign #3: The First Meeting Becomes a Talent Show

Some meetings feel less like diagnostics and more like a one-person Broadway production titled

Look How Smart I Am.

Slides fly. Terms drop. Innovations sparkle. Capabilities march in formation. The broker speaks fluently, confidently, continuously, like a podcast with no pause button.

Then the meeting ends. And nothing useful was learned.

No decision structure mapped. No internal advocate identified. No buying history uncovered. No resistance pattern detected. No qualification signals captured. Just a lot of verbal cardio.

Strong deal leaders treat the first meeting like a structured investigation. They are measuring as much as they are explaining. They are studying decision psychology, not performing intelligence theater.

There is a simple post-meeting test: can you describe exactly how this deal moves forward — and why — based on what you learned?

If the answer is vague, the meeting was noise, not progress. Talking more never created authority. Asking better does.

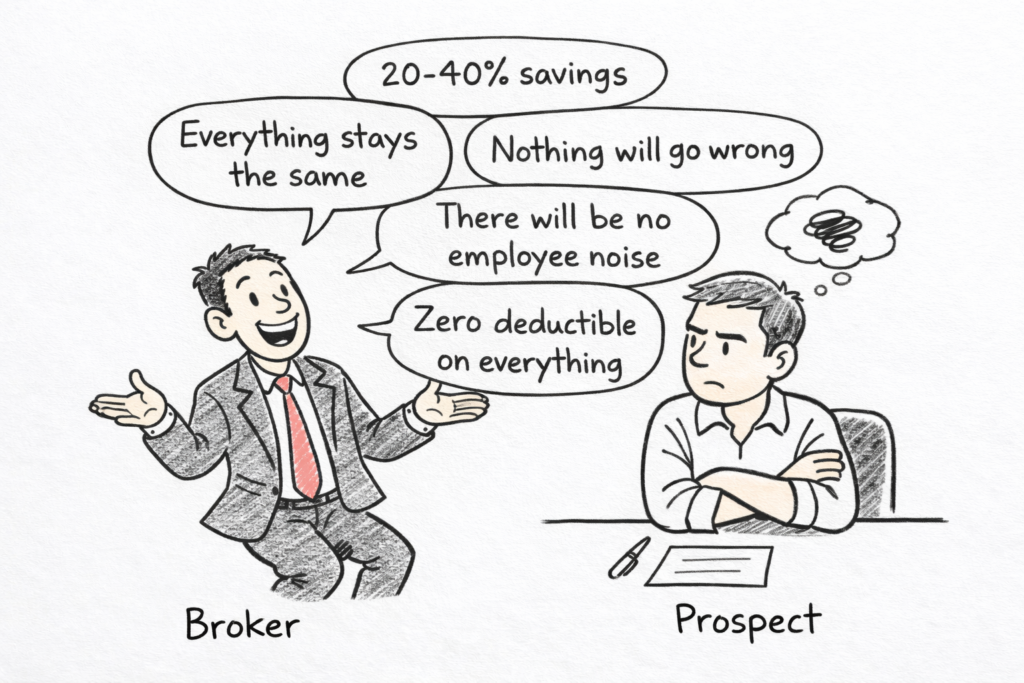

Sign #4: Overpromising Becomes a Lifestyle

The pick-me broker promises like a motivational poster factory.

Savings ranges appear instantly. Complexity becomes “no problem.” Edge cases become “we handle that all the time.” Every structure is manageable. Every outcome is achievable. Every path is smooth. It feels optimistic. It lands as unbelievable.

In advisory markets, buyers don’t equate big promises with big expertise. They equate early promises with shallow diagnosis.

Experts earn the right to speak in numbers. They measure first. They model second. They speak third.

There is also a psychological effect here: when someone promises results before studying reality, the buyer unconsciously downgrades their authority level. Precision without inspection reads as salesmanship, not mastery.

Calm constraint beats excited certainty every time.

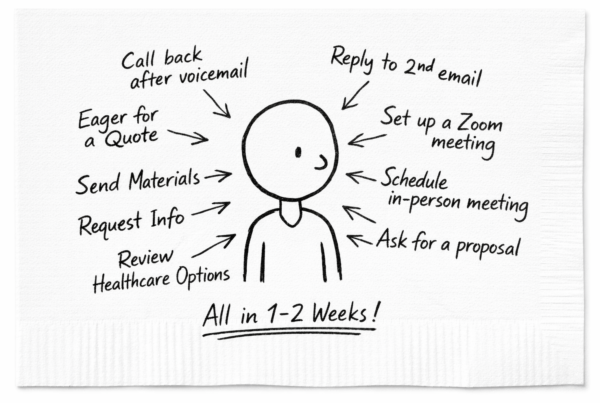

Sign #5: No Structure, Only Improvisation and Hope

Watch how a broker runs meetings and you’ll see their operating system immediately.

Pick-me brokers improvise everything. Questions appear randomly. Qualification happens accidentally. Disqualification never happens. Conversations drift. Next steps float.

It feels relaxed. It produces chaos.

Structured brokers walk in with question architecture. They know what must be discovered, what changes strategy, what signals risk, and what qualifies fit. They are evaluating the client while being evaluated.

That creates a completely different energy in the room: grounded, selective, unhurried. There’s a simple metaphor: one broker is auditioning. The other is casting. Casting gets chosen.

Why Strong Clients Quietly Step Back

Serious companies look for something very specific in an advisor: professional resistance. Not rudeness. Not ego. Resistance.

They expect the expert to protect an informed position – even when agreement would make the conversation smoother. Because the entire reason to hire expertise is to be told what is correct, not what is comfortable.

When a broker agrees with everything instantly, adapts to every suggestion, and never pushes back, a subtle psychological switch flips in the buyer’s mind:

“This person needs my approval more than I need their judgment.”

Authority drops. Value drops with it. Expert posture includes the willingness to say, calmly and clearly, “That approach will hurt your outcome.” And if necessary, to lose the deal rather than support a bad structure.

That willingness is magnetic to serious buyers. It signals conviction, depth, and independence. Unlimited agreeability signals the opposite.

Laser Prospecting is not about avoiding rejection. It's about refusing to let rejection reset your strategy.

Margo White X

The Good News!! Pick-Me Is a Mode, Not an Identity

None of this is permanent. Pick-me is not a personality type. It’s a daily operating mode – and modes can change immediately. The shift is practical.

Write your criteria. Define your anti-avatar. Protect deep work. Enter meetings with question architecture. Stop promising before diagnosis. Practice saying no before you desperately need to.

Even prospecting for 100+ life groups begins with a prior decision: smaller, misaligned cases no longer qualify for your time.

The market reads posture faster than proposals. Standards first. Selection second. Respect follows.

Prospecting Calculator

Run Sales Simulation

In seconds, you’ll see your future numbers, the deals you could unlock, and how sticking to the right targets reshapes your entire business.