Marsh McLennan → McGriff Insurance Services (TIH’s retail brokerage). Completed November 15, 2024. Purchase price: $7.75B cash.

Aon → NFP. Completed April 25, 2024. Enterprise value: $13.0B

Arthur J. Gallagher → AssuredPartners. closed August 18, 2025. Gross consideration: $13.45B

Arthur J. Gallagher → Woodruff Sawyer. Announced March 4, 2025. Consideration: $1.2B.

HUB International (private) → minority equity investment round. Announced May 12, 2025. New capital: ~ $1.6B minority investment; valuation disclosed as $29B total enterprise valuation.

Brown & Brown → Accession Risk Management Group (parent of Risk Strategies + One80). Completed August 1, 2025. Gross purchase price disclosed: $9.825B

The Baldwin Group → CAC Group. Announced December 2, 2025. Deal value: $1.03B (cash + stock disclosed); expected close Q1 2026.

The M&A headlines keep spelling out in numbers: while you’re thinking about what you want for your brokerage, the biggest players are thinking about you. Not you as in “your list of clients” (clients can leave). You as in the way your firm actually operates – the model, the cadence, the speed, the participation-level delivery that big boxes struggle to reproduce without turning it into a committee.

In other words, you might be the gift.

And that’s why it’s worth looking at your brokerage through a buyer’s eyes, even if you never plan to sell. Because the qualities that make a firm attractive to a big insurer or mega-broker are usually the same qualities that make your life less stressful and your company more profitable: a business that works on paper, works in a spreadsheet, and works without needing the founder’s nervous system as the main operating system.

1. Your company, minus You.

What would happen if you disappeared for 90 days? Not “would it survive.” Most firms can survive 90 days by doing nothing ambitious.

The real question is: would it still create value? Would it still win new business? Would clients still feel held, informed, and managed? Would renewals still happen without the founder turning into a 2 a.m. help desk?

A buyer cares because they are not buying your stress tolerance. They are buying continuity. If your firm’s performance depends on your daily presence, the firm isn’t an asset, it’s a job you built with higher overhead. Acquirers discount that instantly because they can’t underwrite “Margo must stay fully engaged forever” as a stable business model.

If you never sell, this still matters because founder-dependence is the most expensive way to run a brokerage. It taxes your calendar, your attention, and your health. If you plan to pass the business to family, it matters even more: you’re not passing them a company. You’re passing them a role you personally perform. And that’s not an inheritance. That’s a burden.

The honest review of the situation that may and may not occur when you leave, brings to the next, more important topic that can already be converted into numbers on a spreadsheet:

Is the value in your company… or in your personality?

This is the most sensitive question in brokerage, because the industry is built on relationships.

But there’s a difference between relationships as a strength and relationships as the entire product.

If the firm’s value is “people like me,” you have goodwill. But goodwill doesn’t transfer neatly. The buyer’s fear is simple: once you’re less involved, retention drops, new business slows, and the thing they bought turns into an expensive leak.

If you never sell, a personality-based brokerage tends to trap the founder in a cycle: constant proving, constant availability, constant emotional labor. And if you want to pass it to family, you have to ask an uncomfortable question: are you passing them a business, or are you asking them to imitate you as a person?

That’s why big firms pay up for brokerages where trust is distributed, not centralized. Where the client feels the firm’s standard, not just the founder’s charm. Where the relationship is institutional, not romantic.

If you hired a sharp producer tomorrow, could they “be you” in 30 days?

Not in tone. In execution.

Could they run your first meeting the way you run it? Could they explain your model to a CFO without you “fixing it” later? Could they handle a renewal without triggering the client’s anxiety?

If the answer is no, you don’t have a company standard. You have personal craft.

Buyers love craft, but they pay for standards. Why? Because standards scale. Standards survive turnover. Standards survive founder absence.

Now Available on Amazon

Survivors inventors

A powerful playbook that shows you how to read every prospect’s mindset, smash through resistance to change, and unlock a clear vision of your brokerage’s future.

2. Systems & Processes

When you say “we’re different,” can you explain it as a process?

Most brokers claim they’re proactive. Most brokers claim they’re consultative. Most brokers claim they care.

None of that is differentiating unless it is expressed as behavior the client can see.

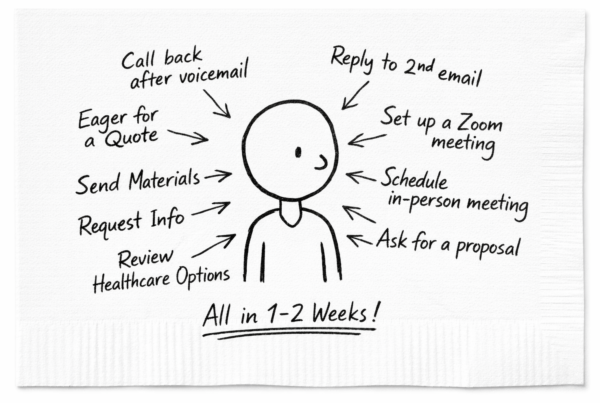

John Clay said something that should change how you view your own service model: what boutique brokers do is a participation sport, not a spectator sport.

Meaning: you don’t show up 60 days before renewal with a spreadsheet and call that strategy. You manage throughout the year – reporting, governance, early look renewal meetings, claims visibility, decisions that don’t become surprises.

That’s not “service.” That’s a process. And if it’s a real process, it has cadence. It has language. It has steps. It can be taught.

Buyers pay for teachable differentiation. If you never sell, a named and repeatable process is the only way to protect yourself from being the only person who “knows how to do it.” If you pass it to family, a process is the inheritance. Not your charisma.

Does your company win new clients on purpose, or by accident?

This is where brokers either get defensive or get honest.

Many firms “get business.” They have reputation, referrals, occasional inbound, a few centers of influence. They call that a strategy.

But buyers don’t pay premiums for hope. They pay premiums for a repeatable acquisition engine.

Not funnels. Not internet marketing fantasy. A business development system that a smart operator can understand and replicate:

✔️ Who you win.

✔️ Why you win.

✔️ Where you hunt.

✔️ What your cadence is.

✔️ How you convert.

✔️ How you expand accounts.

✔️ How you protect retention under attack.

And here’s the real point you raised: because clients can leave, the acquisition system is the only part of the company that truly stabilizes value over time. If you can reliably replace churn and keep growing, your firm becomes more than a book. It becomes a machine.

Even if you never sell, this matters because it determines how much you fear losing an account. It determines whether a renewal loss is a crisis or an annoyance. If you pass it to family, it matters because it gives them something to drive, rather than hoping your name continues to carry the firm forever.

If one key employee quits, do you lose sleep… or do you replace them?

Most brokerages pretend they are “a team,” but they’re actually a set of irreplaceable humans holding tribal knowledge.

The founder knows it. The employees know it. The clients sense it.

Buyers hate that because it’s fragile. It makes integration risky. It turns the brokerage into a dependence network instead of an organization.

But forget buyers. For you, as the founder, this is the difference between running a firm and running a daycare for adults.

If you can’t hire and replace without major damage to your schedule, your company is not scaling, your stress is scaling.

And if you plan to pass the business to family, fragility is the worst gift you can give. You’re handing them a structure where any resignation becomes an emergency, where they must “keep people happy” to keep the company alive.

A firm that can replace talent without collapsing is not cold. It’s mature.

3. Solution Stack & the Financials

Is your solution stack something you own, or something you borrow?

John (Clay) mentioned something during our conversation most brokers haven’t fully digested: private equity isn’t only buying agencies. It’s investing in solutions.

That should tell you what the market is valuing: a firm’s “how,” not just its “who.”

If your brokerage uses transparent PBMs, reference-based pricing, navigation, direct contracting, or any differentiated approach, the question is whether that stack is documented, operational, and integrated, or whether it lives in your head as “what we tend to do.”

Buyers pay for stacks when:

✔️ The criteria for using each tool is clear.

✔️ Implementation is repeatable.

✔️ Outcomes are measurable.

✔️ Vendor management is controlled.

✔️ The story is CFO-ready and defensible.

If you never sell, owning your stack is what protects you from commoditization. If you pass the firm to family, it prevents the next generation from turning into a generic broker who “offers everything” and wins nothing.

Would your company still be impressive on paper?

Not the marketing deck. The paper.

✔️ Clean financials.

✔️ Clear margins.

✔️ Client concentration understood.

✔️ Retention and growth visible.

✔️ Pipeline (sales process) real.

✔️ Operations disciplined.

A brokerage that can’t explain its economics is not “relationship-driven.” It’s unmanaged.

Buyers pay for clarity because clarity reduces risk. But you should want clarity even if you never sell, because clarity is what gives you control over decisions: hiring, compensation, niche focus, marketing spend, and what you stop doing.

If you plan to pass it to family, clarity is respect. You’re handing them a machine they can understand, not a mystery they have to guess at.

The numbers are doing the talking: your boutique, personalized way of operating is exactly what the giants can’t engineer at scale. So they’re paying to acquire it.

Margo White X

Even if you never plan to sell...

Look at your firm through a buyer’s eyes, not because you’re planning an exit, but because it’s the fastest way to tell whether you own a company… or whether the company owns you.

A brokerage that can be sold is usually a brokerage that can breathe. It doesn’t run on founder adrenaline. It doesn’t shatter when one person leaves. It doesn’t require a single face, a single voice, a single nervous system to keep value alive. It has a method. A cadence. A stack that’s truly integrated. Numbers that hold up in daylight. A way of winning that is repeatable—by design, not by luck.

And here’s the point that matters, whether you sell or never do: every renewal is a re-election. Your clients will be targeted again. Your value will be questioned again. The market will test you again. The only protection is not “working harder.” It’s building something that keeps proving itself, even when you’re not in every room.

Marketing is optional. Prospecting is Oxygen.

So take one idea from this and keep it in the back of your mind like a quiet standard: if your brokerage can’t be explained, taught, and delivered without you… it isn’t a business yet. It’s a heroic routine.

Build the kind of firm that survives scrutiny. The kind that earns trust on paper and in practice. The kind that still wins when competitors knock, when staff changes, when the founder steps back.

Whether you sell it, pass it on, or keep it forever—build something that can win every year without needing you as the only reason it can.

Prospecting Calculator

Run Sales Simulation

In seconds, you’ll see your future numbers, the deals you could unlock, and how sticking to the right targets reshapes your entire business.