It’s truly the most wonderful time of the year for brokers. Nothing says “holiday magic” like your last 12 to 36 months showing up with receipts. Every move you made, every move you avoided, every “we’ll circle back” you believed in… comes back as an echo you can’t mute.

And the funniest part is what brokers do with that echo: they immediately plan a vacation from it.

The plan goes like this:

“We’ll take a breath, disappear until the end of January, then come back refreshed, energized, and ready to prospect.”

It’s a charming plan, if prospecting in healthcare would be a mood-based activity. If results were controlled by your emotional reset, and if the year magically reorganized itself because you finally slept 8 hrs and drank less coffee.

But B2B prospecting doesn’t care how you feel. It’s slow, deliberate, repetitive, and brutally honest. It is monotonic on purpose. It’s “boring” the way compounding is boring, until you realize it’s the only thing that actually builds anything meaningful.

The Actual Reset For Brokers

A broker can come back from vacation in the best mood of their life – clear mind, new notebook, fresh promises – and still be completely stuck because nothing in their world actually changed. Still no plan, no specifics, no sequence, no standards, just hope dressed up as “reset.”

But for some of us, January is and/or WILL BE different.

At Prospecting Broker, we reset in January too, and we do it with our clients. It’s essential for all of us to begin the year with a sober understanding of which courses of action offer a reasonable probability of success – and which merely offer activity disguised as progress.

And it all starts with building Top 30 Laser Prospecting List.

Before your thinking is hijacked by motivational noise – before someone tells you to “10X,” shoot for the stars, or flood the market with more emails – you still know, with unsettling clarity, what you ACTUALLY need. Not everything. Not everyone. One or two transformational wins that would materially change the trajectory of your firm.

Now Available on Amazon

Survivors inventors

A powerful playbook that shows you how to read every prospect’s mindset, smash through resistance to change, and unlock a clear vision of your brokerage’s future.

1. Primary Goal

When you sit down to define your Top 30, there is one decision that comes before all others. And it is not who goes on the list.

It is why this list exists in the first place.

Your Top 30 must be built around one primary goal. Not because the others are unimportant, but because trying to serve all of them at once guarantees that none of them will work properly.

In practice, this means choosing one of the following directions and allowing it to dominate your thinking for the year.

First option: pushing your firm into a new client size category.

This is the most common – and often the most necessary – goal. If your firm has historically worked with 50- or 100-life groups, the move into 500+ life clients is not incremental growth. It is a structural shift. Different buyers. Different risk tolerance. Different expectations. Your Top 30, in this case, exists to break a ceiling that activity alone will never break.

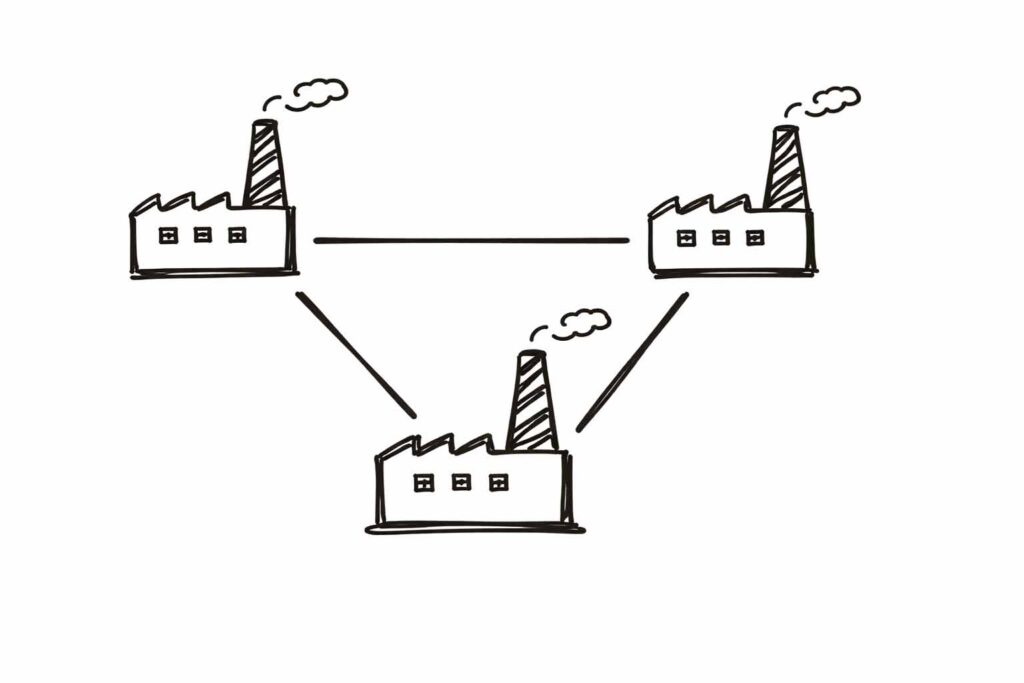

Second option: gaining access to a new industry.

Here the Top 30 is not about size, but about positioning. One well-chosen company in the right vertical can do what years of outbound effort cannot. Automotive, real estate, retail, manufacturing – once you land a recognized name, other companies in that industry stop treating you like an outsider. Credibility becomes transferable.

Third option: elevating your brand and PR positioning.

This goal is often misunderstood, but extremely powerful. The employee count may not be impressive. The revenue may not be transformative. But the name matters. A respected brand in your portfolio quietly reshapes how future prospects perceive risk. In my own case, PwC played that role. It wasn’t a massive group, but it fundamentally changed how my prospecting conversations were received afterward.

Fourth option: closing a financial gap.

This is the option people rarely admit out loud, but quietly rely on. The market is full of multi-million-dollar companies with no recognizable brand equity. They are spreadsheet-driven, cost-focused, and aggressive on savings. PEPY is tight. Decision-making is rational, not emotional. These companies won’t elevate your image, but they can stabilize, fund, and scale your business through sheer size.

Now, when these options are presented, the instinct is to combine them. A little size, a little industry access, a little brand power, and just enough revenue security to feel safe. The mental process looks suspiciously like choosing inside Cartier – this one is nice, that one too, maybe both.

That instinct is exactly what breaks the Top 30.

Yes, it would be ideal to have all four. No one disputes that.

But the purpose of defining this year’s primary goal is not to describe your ambitions. It is to force a directional shift your firm has not yet made. That kind of shift requires concentrated effort over time.

Even the largest insurance companies – those with thousands of employees and budgets comparable to the GDP of a small European country, operate this way. One focus at a time. One strategic direction. Full execution.

If they need that discipline, so do you.

And without it, your Top 30 becomes just another list that feels impressive in January and meaningless by March.

2. Industry

Industry choice is not a detail. It is a constraint, and a very useful one.

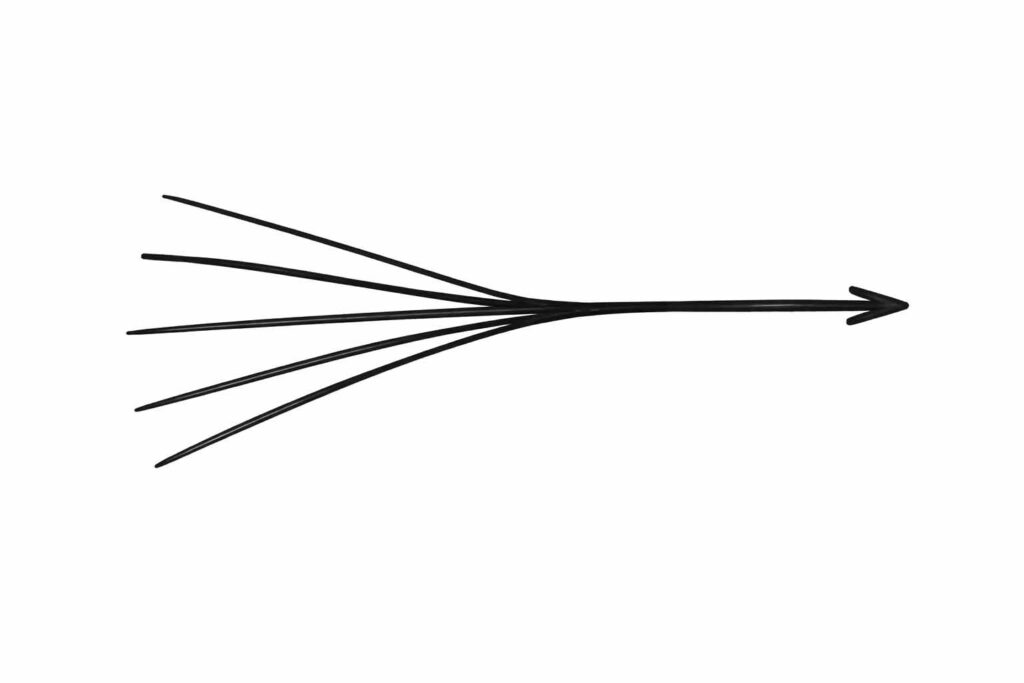

If your primary goal is access to a new industry, then this part is simple. Your Top 30 comes from that industry. Full stop. No diversification. No hedging. The entire list points in one direction.

If your primary goal is something else, like client size, brand elevation, or closing a financial gap, you can diversify. But this is where most people underestimate the cost of that decision.

Laser Prospecting is not compatible with surface-level understanding. Once an industry enters your Top 30, you are committing to going down the rabbit hole.

You are signing up to know what is happening there daily: who is consolidating, who is under pressure, what regulations are changing, how supply chains are shifting, where margins are being squeezed, and what competitors are quietly doing differently.

This level of awareness is not casual. It becomes an obsession.

Let me make this concrete.

I work with brokers, TPAs, and Stop-Loss carriers. My mornings are not particularly glamorous. I walk my dogs, get coffee, sit down with my iPad, and I read insurance news. But I don’t only read about brokers. My reading list includes companies like Marsh McLennan, Aon, Gallagher, and others that shape the market.

These firms create trends. They signal direction. My job is not just to know what happened yesterday, but to understand where my clients (and my future clients) are being pulled next.

And that’s only the visible layer.

I also research aggressively and, yes, I call companies directly. Sometimes I position myself as a client. I want to hear how competitors are pitching, how they frame value, how negotiations are handled, where friction shows up. This is not curiosity, it’s intelligence gathering. And it takes time, focus, and a surprising amount of energy.

This is why industry selection matters so much.

When you choose industries for your Top 30, the real question is not how many industries sound interesting. The question is: how many industries are you realistically willing to master? Your time is finite. Your cognitive bandwidth is finite. And Laser Prospecting does not tolerate “good enough.”

You cannot be average here. You cannot skim. You cannot do “just a bit.” Or, to borrow a blunt but accurate line from the book Greenlights (by Mathew McConaughey): don’t half-ass it.

This is why, at Prospecting Broker, when we build Top 30 lists with brokers, TPAs, and Stop-Loss carriers, we cap it at three industries per list. Maximum.

Yes, our CRM infrastructure does a great deal of the heavy lifting – collecting data, tracking changes, analyzing signals, and delivering a daily, condensed intelligence “squeeze.” But you still have to read it. You still have to internalize it. And you will be the one using that information in conversations that actually matter. Three is the ceiling. One or two is usually better.

And remember, this is not about restriction. It is about precision.

3. Size

Let’s get one thing out of the way early: size matters in prospecting. A lot. Anyone telling you otherwise is either being polite. Or bad at math.

When you work with a Top 30 list, you are deliberately limiting volume. You are choosing depth over breadth. And when you do that, the reward on the other side has to justify the effort. Going deep on the wrong size of company is not strategy. It’s charity.

Here’s what this looks like in real numbers, without drama.

You run a small brokerage firm, doing up to $1M a year in revenue. You decide to Laser Prospect 30 companies, each with a minimum of 200 lives. You do the work. You stay consistent. And by the end of the year, you close just three of them. Not ten. Not half. Three.

That already puts roughly 700-800 lives into your portfolio.

We all know the broker math. Average income per life is about $600. The average client stays at least three years (often longer, but let’s stay conservative so nobody accuses us of optimism).

That’s $480,000 a year. Over three years, that’s $1,440,000 added to your business.

For three wins.

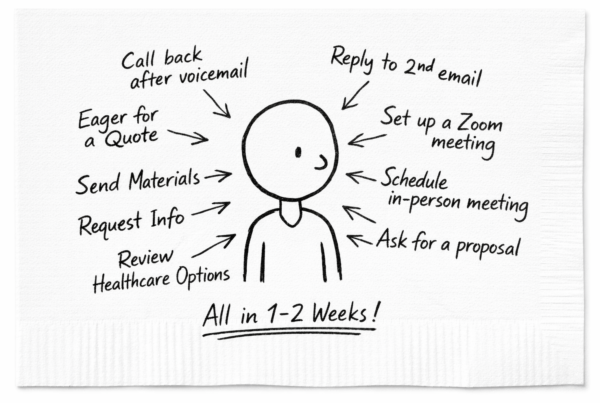

Suddenly, the fact that 27 companies said no doesn’t feel nearly as tragic. Especially when you remember that complex B2B prospecting cycles run anywhere from 12 to 36 months. Those “no’s” are often just “not yet.” Nothing is wasted. You’re simply early.

This same logic applies directly to Third Party Administrators and Stop-Loss carriers.

If your goal is to attract brokerage firms as partners, the math changes, but the principle doesn’t. Three or four strategically chosen broker partners can outperform dozens of random ones. These are brokers who market consistently, who align with your goals, and who don’t treat you like just another vendor on a spreadsheet.

When that alignment exists, and when you actively help them convert new clients, they don’t just stay. They become loyal. Vocal. Slightly annoying in the best way. They grow your business and act as brand advocates, attracting other brokers like them with very little additional effort.

But this only works if you size brokers correctly.

And no, sizing a broker is not just about their current book of business. Years in the market matter. Reputation matters. Credibility matters. Marketing behavior matters. Yes, even social media presence matters, whether you like it or not.

Most TPAs and Stop-Loss groups make the same mistake: they chase brokers, trying to convince them to move an existing portfolio. The smarter ones do the opposite. They choose brokers who are actively growing and help them bring in new business first. Once that happens, portfolio transfers stop being negotiations and start being inevitabilities.

Is it effortless? Absolutely not. Is it worth it? Well, you decide.

When the size is chosen correctly, the work compounds. The brokers win. You win. The clients win. Which is exactly how these deals should work.

4. Wound

When we first began working with brokers at Prospecting Broker, we did what everyone else does. We analyzed public benefits data. We studied plan designs. We looked for pricing inefficiencies, contribution structures, cost gaps – the respectable, spreadsheet-approved approach.

And yes, sometimes numbers are the reason they start paying attention to what you say. But practice has a way of humbling theory. What we learned very quickly is this: the projects your competitors miss are almost never hiding in spreadsheets. They’re hiding in places spreadsheets cannot see.

Real opportunity shows up when you stop researching plans and start researching people, pressure, and timing.

Here’s what that actually looks like.

✔️ A recent change in the C-suite. New CEO. New CFO. New HR leader. These people did not inherit the old structure emotionally. They didn’t negotiate it. They didn’t defend it. They don’t feel loyal to it. In fact, they often want distance from it. New leadership almost always means new partnerships.

✔️ Employee “noise.”

Not the kind that shows up in a utilization report. The kind you hear over the phone. Hesitation. Fatigue. Frustration disguised as politeness. You will never find that in a file. You will hear it if you ask the right questions.

✔️ An incumbent acquisition.

When a company’s current broker or carrier gets acquired by a larger organization, bureaucracy follows. Always. More layers. More process. Less flexibility. What once felt responsive suddenly feels slow. That transition period is a wound, especially for clients who valued access and speed.

✔️ The “critical cooperation year.”

Have you heard of it? Or have you ever CONSIDERED it in your prospecting process, or with your clients? In insurance, this tends to happen around year five. Long enough for the honeymoon to be over. Long enough for frustration to accumulate. Long enough for decision-makers to start wondering whether staying loyal is actually costing them something. Nothing explodes. But something shifts.

…And that’s just the short list.

These are wounds. Structural, emotional, political, timing-based wounds. They don’t bleed on paper. They don’t announce themselves in reports. And they are completely invisible to the lazy broker who scrolls ZyWave files, sorts by PEPY, and calls it prospecting.

But they are obvious if you do the work. This is the difference between looking informed and being dangerous. This is where Laser Prospecting stops being a process and becomes pattern recognition. Call it intuition if you want, but intuition is usually just experience plus effort.

If you want a dramatic metaphor, this is the part where the Matrix glitches. Most people don’t notice. The ones who do aren’t special. They’re just paying attention.

And those are the ones who deserve a place in the Top 30.

5. Competition

If you know the incumbent well, you already know 50% of your prospect. Not their logo. Not their SIC code. Their decision logic.

Competition is not a side note in Top 30 selection. It is not background context. It is not something you “figure out later.” Knowing who currently holds the account (and WHY) determines your probability of winning more than almost any other variable.

Because (and here comes the uncomfortable part…) THE MARKET IS FAIR.

Not fair in the way people want it to be fair. But fair in the sense that every incumbent is protecting someone’s interest. The offer in place right now may look bad on paper. It may frustrate employees. It may even underperform financially. But it is doing something very well for someone – otherwise it wouldn’t exist.

Your job is not to judge that. Your job is to understand it.

Every incumbent has a strong side. Even the ones brokers love to mock. Even the ones with ugly spreadsheets. Even the ones you’re convinced are “clearly losing this account any minute now.” If they are still there, they are winning on something.

Maybe it’s political safety.

Maybe it’s predictability.

Maybe it’s a relationship no one wants to disrupt.

Maybe it’s convenience.

Maybe it’s risk containment.

If you don’t know what that strong side is, you are not competing, you are guessing. And guessing feels terrible in boardrooms.

So when you analyze competition, you are not asking, “Where are they weak?”

You are asking, “What problem are they solving well enough that change hasn’t happened?”

Just like you cannot master ten industries from scratch, you cannot deeply understand ten competitors from scratch. It’s cognitively impossible. And pretending otherwise is how brokers end up with shallow opinions and recycled talking points.

This is one of the quiet discipline rules we use at Prospecting Broker.

We deliberately limit the number of competitors our clients focus on. Usually no more than five. Not because the market only has five players, but because mastery beats awareness.

When you narrow the competitive field, you stop “studying” competitors and start developing the skill to beat them. You learn their patterns. Their defaults. Their negotiation posture. Their blind spots. You know when their offers are rigid and when they’re flexible. You know what they will never concede, and what they always trade away.

That’s not theory. That’s leverage.

A Top 30 list built around a limited number of competitors is not restrictive, it’s surgical. It allows brokers to stop reacting and start anticipating. And anticipation is what separates displacement from polite rejection.

So yes. Competition is half the equation.

If you know your competitor deeply, you already understand the logic that selected them. And if you understand that logic, you don’t need to guess what will move the account.

You just need to be patient enough to wait for the moment when it does.

Laser Prospecting is not about avoiding rejection. It's about refusing to let rejection reset your strategy.

Margo White X

That's All For The "No."

If there is one thing this entire conversation should have done, it’s remove the illusion that a Top 30 list is a motivational exercise. It’s not. It’s work. Quiet, disciplined, sometimes boring work that no one applauds, and that most people postpone until it’s too late.

I hope I’ve given you enough reasons to treat your 2026 Top 30 with respect. To choose it carefully. And then, once chosen, to actually commit to it instead of treating it like a draft that can be rewritten every time doubt shows up.

But here is the real reason this matters.

No matter who ends up on that list, at some point in the process you will hear “no.” Not a dramatic no. A polite one. A delayed one. A “circle back next quarter” no. The kind of no that tests patience, not confidence.

And after that no, you will still have to continue.

You will still make the calls.

You will still show up at events where that prospect is present.

You will still speak with other decision-makers.

You will still gather intelligence, send thoughtful follow-ups, and do the unglamorous work that quietly compounds.

Marketing is optional. Prospecting is Oxygen.

Yes, this takes time. Yes, it costs energy. And yes, this is exactly where most brokers decide they are “being efficient” and move on to someone easier.

That’s the difference.

Laser Prospecting is not about avoiding rejection. It’s about refusing to let rejection reset your strategy. The effort pays off only when it is applied consistently to the same list – not when companies are dropped after the first no and replaced with fresh optimism and zero context.

Choosing the right targets in the first place is at least half the outcome. Possibly more. Because persistence without precision is just noise with a calendar.

And now that you understand how much work real prospecting actually requires, one thing should be very clear: there is no December or January to waste. There is no “quiet period.” There is no pause button.

All of it counts. All of it is prospecting. All of it is work on your future clients. And if you do it right, the no’s won’t stop you. They’ll just become part of the process you finally trust.

Prospecting Calculator

Run Sales Simulation

In seconds, you’ll see your future numbers, the deals you could unlock, and how sticking to the right targets reshapes your entire business.